6 tips for keeping good tax records

Most small business owners know the importance of tracking expenses and keeping good tax records.

Still, many of us end up scrambling during tax season to chase down receipts or poring over calendars at the end of the year to add up work-related mileage.

These last-minute efforts waste time, and there’s also a good chance that regularly failing to track expenses and other tax-related records ends up costing you money, both through missed deductions and by paying your accountant for the extra related time to getting your returns prepared.

It doesn’t have to be that way, particularly for today’s small business owners. New technology and a host of small business-related apps have made keeping good tax records easier than ever. Taking some time to automate and simplify your approach can make tax season a breeze and help make sure you get the small business tax breaks and benefits you deserve.

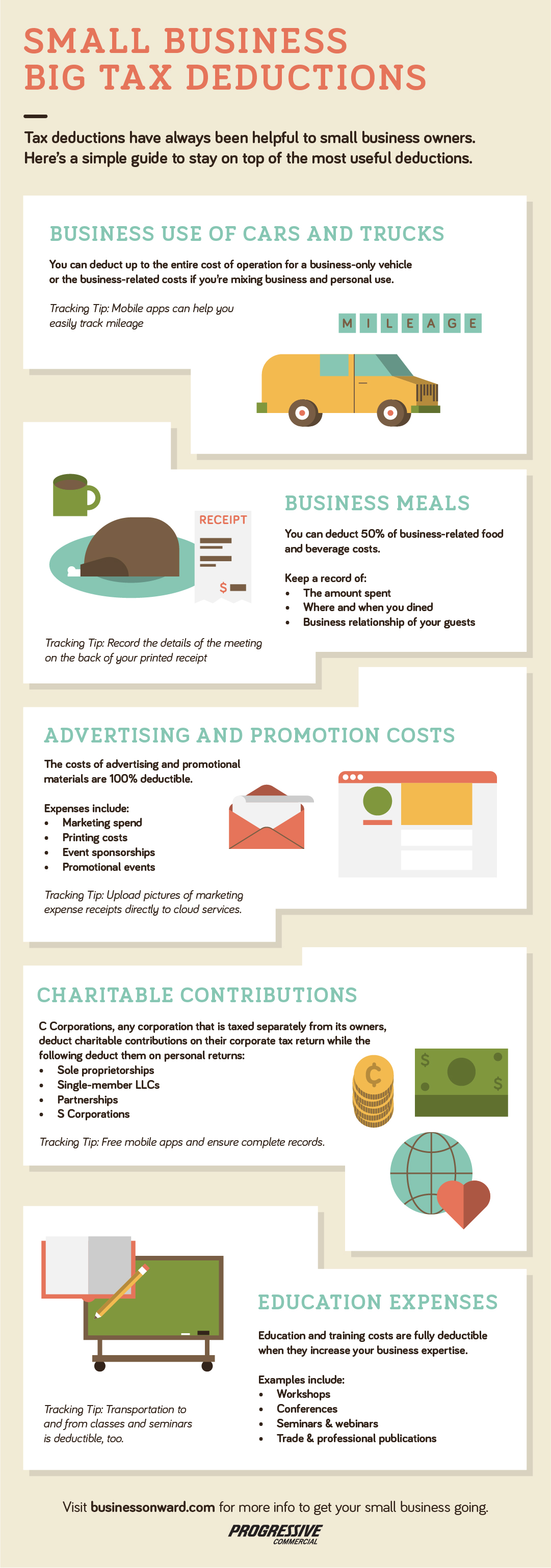

Here are six ways you can keep better track of tax-related information all year long. Check out the infographic, too.

1. Use automated accounting programs

Cloud-based accounting programs such as Quickbooks, Zoho Books, or FreshBooks have been game-changers for small business owners. The key is to make the most of the many features small business accounting platforms offer. You can track, manage, and forecast income and expenses in ways that ensure you’ll always be ready for tax season. Many of these tools will even export reports or transfer data directly into tax software platforms like TurboTax, to make tax time even easier.

2. Track your expenses with apps

Say you’re a busy caterer always on the go, or a real estate agent jumping house to house. Cramming your business receipts in your glove compartment or stuffing them into a shoebox under your desk doesn’t cut it anymore. Instead, download one of the many apps that allow you to take pictures or scans of your receipts and other important tax-related documents and then have them immediately categorized and sent to cloud storage. Shoeboxed, Expensify and Neat offer small business owners a convenient way to stay organized. You never lose a receipt and these services will organize them into a personalized online database.

3. Use separate business and personal credit cards

Personal and business expenses don’t mix, particularly if you have to sort through them at the end of the year and figure out which is which. A simple fix: Make sure you have a business credit card and pay all of your business expenses with it. Not only do you avoid co-mingling business and personal expenses, but at the end of the year, your credit card statement offers a solid record of all your business spending. And an increasing number of business credit cards offer cash back incentives, which can help manage your costs.

4. Track your charitable contributions

If you run a retail business such as a florist or bakery, odds are pretty good that you frequently get asked for donations or sponsorships for charitable events. There are free apps such as ItsDeductible and Donation Assistant that make tracking your charitable donations easy and assure that you have good records at the end of the year. Keep in mind that a sponsorship in which your business name is displayed on a jersey or at an event is typically classified as an advertising business expense—and a deductible one at that.

5. Measure miles as you go

There really is no excuse for not accurately tracking mileage. A wide range of apps such as Stride Tax, MileIQ, or Simple have replaced the notebook in the glove compartment. Many of these apps make it easy to categorize business and personal travel and keep an ongoing log of the miles you’ve traveled for business. At the end of the year, it’s a few simple clicks to get an accurate account for tax purposes.

6. Store records post-tax season

The IRS recommends keeping your tax records for three years. Make sure you store those tax records safely and securely. If you're storing your returns on the cloud, for example, it’s a good idea to take some security precautions, including using a password manager to ensure that your passwords are complex and unique from site to site. Password managers such as StickyPassword, Blur, or LastPass offer free options. Also enabling two-factor authentication makes it difficult for identity thieves to access your information. If you’re keeping paper returns, lock them in a secure filing cabinet or even in a bank safety deposit box. Once it’s time to dispose of old tax documents, make sure to shred them using a cross-cut shredder.

It’s never been easier to keep tax-related information up to date and organized. Using technology and some key apps can help ensure that the next tax season will be a breeze—and you don’t miss out on any of your hard-earned tax breaks and benefits.

This information is provided for informational purposes, may not be applicable to all situations, and is not intended to provide legal, tax, or financial advice. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

Simple guide to small business tax deductions